Get answers to frequently asked questions about Coronavirus Economic Impact Payments.

Table of Contents

Many Sunward members are expecting a Coronavirus Economic Impact Payment as a result of the American Rescue Plan Act of 2021. Per the IRS, they are reviewing the tax provisions within the plan and recommend checking this page for the latest updates.

As Sunward receives electronic payment information for our members, we will process it as quickly as possible. Please see below for frequently asked questions and additional information. Additionally, this page from the IRS has helpful FAQs.

Visit IRS.gov for Payment Info Check the status of your payment at IRS.gov

HAS MY ECONOMIC IMPACT PAYMENT BEEN DEPOSITED?

The best way to see if your payment has been deposited into your account is to use online or mobile banking, or automated phone banking. Please note that you must call us to enroll in automated phone banking prior to using it. Our Contact Center is receiving a high volume of calls at this time and our representatives cannot provide any additional information regarding the status of your impact payment other than what is already available within online and mobile banking.

WHEN WILL I RECEIVE MY ECONOMIC IMPACT PAYMENT?

The government is sending out the payments in waves over the next few weeks. When you receive your payment will also depend on if the IRS has your direct deposit information, or if they will send a paper check to your last known address. Sunward does not know the status of your payment or when you will receive it. The IRS has set up this tool to enable you to check the status of your payment. If you enter your information on the IRS tool and see “Status Not Available”, visit this page for more information.

WILL I RECEIVE MY PAYMENT ELECTRONICALLY OR VIA PAPER CHECK?

In most cases, your stimulus payment will be deposited in the same account as your 2018 or 2019 tax refund if you supplied account information with your return. Sunward does not know how your payment will be delivered to you. Please use the IRS tool to check the status of your payment.

I EXPECT TO BE SENT A PAPER CHECK. WHEN WILL I RECEIVE IT?

Sunward is not involved in the mailing of paper Economic Impact Payments. Please use the IRS tool to check the status of your payment.

HOW CAN I DEPOSIT THE PAPER CHECK I RECEIVE?

You can deposit checks at a Sunward branch, or quickly and securely through online and mobile banking. You may also search for an ATM near you that accepts deposits.

Please note: If two people are listed on the check, both individuals need to sign (endorse) the back in order to deposit it.

Additionally, the name listed on the check must match the name on the Sunward account to which the check is being deposited. For example, members could not deposit a check that is payable to a small business or trust into their individual account.

I THINK A CHECK I RECEIVED MAY BE FRAUDULENT. IS THERE A LIST OF SECURITY FEATURES ON ECONOMIC IMPACT PAYMENT CHECKS?

The Secret Service and the U.S. Treasury offer this guide to assist individuals in determining the security features of Economic Impact Payment checks.

I’M UNSURE IF I LISTED MY Sunward ACCOUNT ON MY TAXES.

Please check your copy of your most recent tax return to confirm which account you listed for your refund. You may also use the IRS tool to check the account to which they are directing your payment.

I DID NOT INCLUDE BANK ACCOUNT INFO ON MY 2018 OR 2019 TAXES. HOW CAN I RECEIVE MY PAYMENT ELECTRONICALLY?

If you did not supply account information on your 2018 or 2019 taxes, you can use the IRS tool to supply your bank account information to them in order to receive your payment electronically.

You will need to give the IRS:

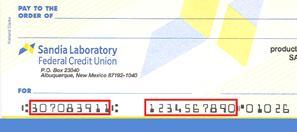

- Sunward's routing number: 307083911

- Your Sunward account number in the correct format. It is important you follow the requirements below in order to submit your Sunward account number in the correct format.

To set up a deposit to a savings account: Use the account number and product ID for that account. For example, if your savings account number is 1234567, and you would like your deposit to go to your 0002 savings account, enter your account number as 12345670002.

To set up a deposit to a checking account: In online banking, select the Accounts widget and click on the checking account you would like to use for your direct deposit. Then select the Account Details tab and look for the "Auto WD & Direct Deposit #." You may also obtain this information by calling us or sending a secure message.

How to find the correct checking account number on your checks: Use the number printed on the bottom of your checks as shown in the image below. The automatic withdrawal and direct deposit account number is in the red box on the right side of the check. The last number string – 01026 in the image below– is the number of that individual paper check and should not be included. Sunward's routing number is in the red box on the left side of the check.

To select between a savings or checking account: When setting up a deposit, there should be an option to indicate if the account is savings or checking. Indicate the account type to which you would like the deposit.

For tax refunds and Economic Impact Payments:

- When setting up a direct deposit, specify if the account is a savings or checking.

- All named recipients on the economic impact payment must be owners or joint owners of the specified Sunward account. A person who is not a joint owner on the account cannot deposit their payment into your Sunward account.

THE IRS SAYS MY PAYMENT WAS SENT ELECTRONICALLY, BUT I DID NOT RECEIVE IT IN MY ACCOUNT.

You can use the IRS tool to see where your payment was sent. If the information displayed in the IRS tool looks correct and reflects your correct Sunward account information, you may send us a secure message in online or mobile banking or call us at 505.293.0500 or 800.947.5328.

Additionally, letters should be mailed to individuals by the IRS after payment is sent, letting you know how your payment was directed and what to do if you did not receive it.