Money management is an important part of your financial life. It provides a complete picture of your financial situation, which allows you to plan better for your future. Sunward’s financial education partner, BALANCE Financial Fitness, offers an educational module that explains the basics of money management, among a variety of other financial topics.

Start your journey to successful money management with the following tips:

SET GOALS

Setting specific goals is crucial to ensure you get where you want to be. There is a big difference between wanting to save money and successfully putting $500 into a savings account each month. Being as specific as possible when setting your goals provides structure to your money management and allows you to plan out how you need to set your budget.

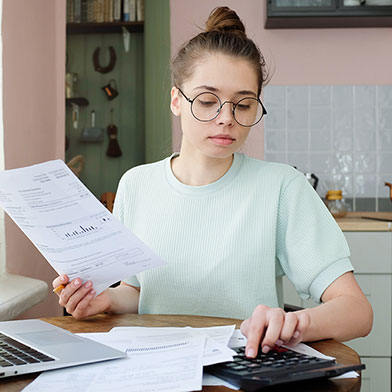

GET ORGANIZED

Ensuring your information and paperwork are easily accessible and in order helps eliminate time-wasting stressors like searching for documents, uncertainty about account balances, and missed bill payments. Keeping your financial information organized is essential to efficient money management.

TRACK SPENDING

The golden rule of money management is to spend less than you earn. Not sure if you are following the golden rule? By keeping track of your spending, you can see how much your purchases cost and adjust your budgets accordingly. After tracking your expenses for at least one month, examine your findings to determine if you are following the golden rule.

BUILD A BUDGET

A budget sets limits on spending to ensure your expenses do not exceed your income. To build your budget, list and total your monthly net income and expenses separately, then subtract the expenses from your income. This provides an overview of what money is coming in and what is going out. Based on this information, identify where you want to make budgetary changes. If too much money is going to specific purchases, try to cut spending on non-essential items.

SAVE MONEY

If you are unsure how much you should be saving, a good rule of thumb is to set aside 10-20% of your monthly net income. If you can’t afford to set aside 10-20%, begin with whatever you can afford. This will help keep your savings goals on track and will provide a savings cushion for unexpected emergencies.

Interested in learning more about money management or other financial fitness topics? Visit slfcu.org/Balance.