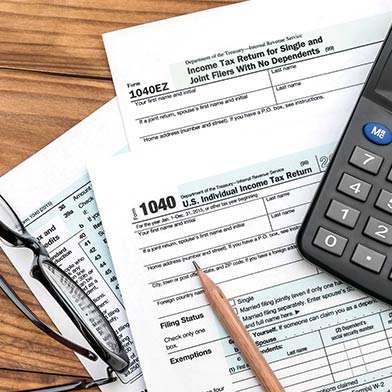

2023 IRS tax forms generated by Sunward will be mailed by these dates and will also be available in online banking.

Table of Contents

2023 IRS tax forms will be mailed by the following dates. Tax documents generated by Sunward will also be available in online banking.

JANUARY 31

- 1098 Mortgage interest paid

- 1098-E Student loan interest paid over $600

- 1099-INT Account dividend income over $10 and/or redeemed bond interest income

- 1099-C Loan cancellation of debt

- 1099-Q CESA (Education) IRA distributions

- 1099-R Traditional, SEP, and Roth IRA distributions

MARCH 15

- 1042-S Account dividend income over $10 (paid to some nonresident aliens)

APRIL 30

- 5498-ESA Coverdell ESA (CESA) education contributions

MAY 31

- 5498 Traditional, SEP, and Roth IRA contributions

YOU'VE GOT MAIL!

To ensure these important tax documents reach you, please make sure we have your correct address on file. If you have a new address, please update your information in online or mobile banking, contact us at 505.293.0500, or stop by a branch.